State Residency for FAFSA: Requirements and Timelines Explained

Understand state residency for FAFSA purposes

Establish legal residency in a state can have significant implications for your free application for federal student aid (FAFSA) and finally affect your college costs. Many students and families find the residency requirements confusing, peculiarly when they’ve latterly moved or plan to relocate for educational purposes.

This guide examines the criteria that determine when you become a legal resident of a state forFAFSAa purposes, how residency affect your financial aid package, and what steps you can take to establish residency efficaciously.

Why state residency matter for FAFSA

State residency status direct impact two major aspects of college financing:

In state tuition eligibility

Public colleges and universities typically charge importantly lower tuition rates to state residents. The difference between in state and away of state tuition can amount to tens of thousands of dollars per year. For example, many flagship state universities charge out of state students two to three times more than residents.

State base financial aid programs

Most states offer grants, scholarships, and other financial assistance solely to their residents. These state aid programs oftentimes work alongside federal aid determine by your FAFSA to create your complete financial aid package.

When you complete the FAFSA, your state of legal residence determine which state aid programs you may qualify for, irrespective of where your choose college is located.

General requirements for establish state residency

While each state set its own specific residency requirements, most share common criteria that determine when someone become a legal resident for tuition and financial aid purposes:

Physical presence requirement

Virtually all states require you to physically live within state borders for a specify period before claim residency. This duration — usually call the” durational requirement”—typically range from 12 to 24 months, depend on the state.

During this period, you must maintain continuous physical presence with alone reasonable temporary absences (such as holiday visits to family )

Intent to remain permanently

Beyond physical presence, states require evidence that you intend to make the state your permanent home, not merely reside thither temporarily for educational purposes. This” intent to remain ” s frequently the virtually challenging aspect to prove.

States look for concrete actions that demonstrate your commitment to establish roots in the community beyond your college years.

Financial independence

Many states require students to demonstrate financial independence from out of state parents or guardians before grant residency status. This requirement can be specially challenged for traditional college age students who nonetheless receive significant financial support from their families.

State specific residency timelines

The wait period to establish residency vary importantly by state:

States with 12 month residency requirements

Many states, include California, Florida, Illinois, Michigan, New York, and Texas, typically require 12 continuous months of physical presence before grant residency status. Nonetheless, each have its own specific criteria for prove intent to remain.

States with longer residency requirements

Some states impose hanker wait periods. For example, Alaska and Vermont require 24 months of continuous residency before qualify for in state tuition rates and state financial aid programs.

Source: studentaid.gov

States with shorter or variable requirements

A few states have more flexible residency requirements under certain circumstances. For instance, some states may grant immediate residency to active duty military members and their families, or have special provisions for those who purchase property or start businesses in the state.

Special considerations for different student categories

Dependent students

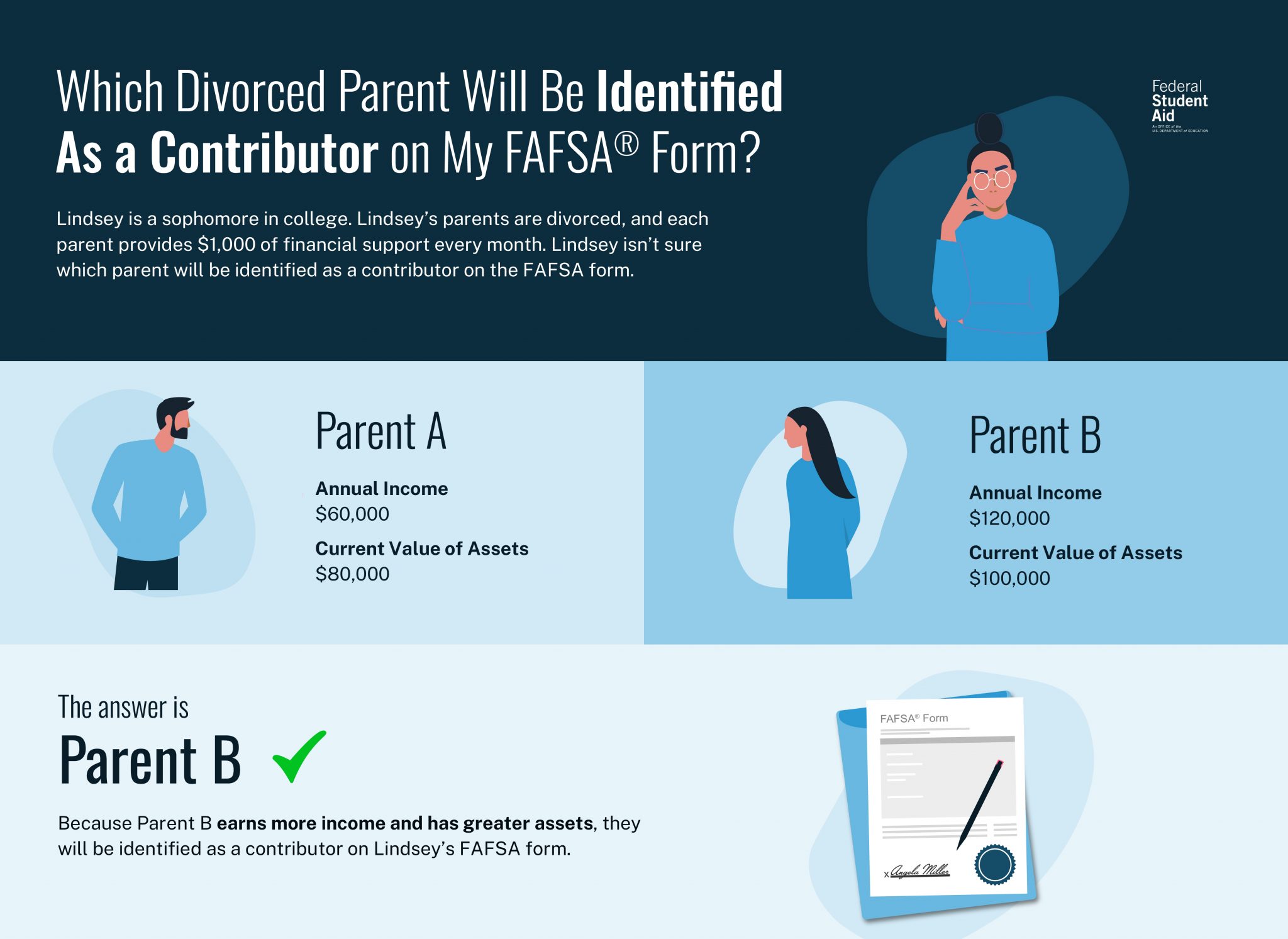

For FAFSA purposes, dependent students loosely take the residency of their parents or legal guardians. This mean that flush if you move to attend college in another state, your legal residency typically remains with your parents’ state of residence.

This can create complications when parents live in different states or have late moved. In such cases, theFAFSAa mostly consider the state of residence to be where the parent who provide the majority of financial support lives.

Independent students

Students who qualify as independent on the FAFSA have more flexibility in establish their own state residency. Independent status is grant to students who:

- Are 24 years of age or older

- Are married

- Have dependent children

- Are veterans or active duty military

- Are orphans or wards of the court

- Are homeless or at risk of homelessness

- Have been grant a dependency override by a financial aid administrator

Independent students must notwithstanding meet the state’s residency requirements, but they’re evaluated base on their own circumstances quite than their parents’.

Military students and families

Active duty military members and their dependents benefit from special provisions under federal law. The higher education opportunity act and veterans access, choice, and accountability act provide protections that allow military families to maintain residency in their home state or establish residency in the state where they’re station.

Document your state residency for FAFSA

To will prove your state residency for FAFSA and in state tuition purposes, you’ll typically will need to will provide multiple forms of documentation. The well-nigh usually accept evidence include:

Primary documentation

- State driver’s license or ID card issue at least 12 months anterior

- State voter registration

- State income tax returns for the previous year

- Property tax receipts show a primary residence in the state

- Year round lease agreement or mortgage documents

Support documentation

- Utility bills show consistent service at your in state address

- Bank statements with an in state address

- Employment records show in state work

- Vehicle registration in the state

- Professional licenses issue by the state

The more documentation you can will provide, the stronger your case for residency will be. Most institutions require multiple forms of proof that span the entire durational requirement period.

Actions that can jeopardize residency claims

Certain behaviors may undermine your claim to state residency, flush if you’ve physically live in the state for the requirement period:

- Maintain a driver’s license or vehicle registration in another state

- Return to your previous state during summer breaks or extended periods

- File taxes as a resident of another state

- Receive financial support from out of state parents who claim you as a dependent on their taxes

- Maintain your primary bank account in another state

- Register to vote in another state

Consistency is key when establish residency. Contradictory documentation or behavior can result in denial of residency status.

Strategies for establish state residency

If your plplannedo establish residency in a new state forFAFSAa and tuition purposes, consider these strategic approaches:

Gap year or community college commencement

Some students choose to take a gap year to work in their target state before enrol in college, or they attend a community college while establish residency. This approach allow them to meet the durational requirement before transfer to a four-year institution as a resident.

Early residency actions

As shortly as you move to the new state, take immediate steps to establish your presence:

- Obtain a state driver’s license or ID

- Register to vote

- Open local bank accounts

- Register vehicles in the state

- Secure year round housing (not equitable academic year housing )

- File state taxes as a resident when applicable

Employment in the state

Secure employment in your new state strengthen your case for residency by demonstrate ties to the local economy and community. Full-time employment during gap years or part-time work during studies can be specially valuable evidence of your intent to remain.

Residency exceptions and special programs

Many states offer exceptions to standard residency requirements or participate in programs that provide tuition benefits irrespective of residency status:

Regional exchange programs

Several regional compacts allow students from member states to attend out of state public institutions at reduce tuition rates:

- The western undergraduate exchange (wwe))

- The Midwest student exchange program (mmsec)

- The New England regional student program (rRSP)

- The southern regional education board’s academic common market (aACM)

These programs typically offer tuition at 150 % of the in state rate kinda than the full out of state price — a significant savings.

Border county exceptions

Some states grant in state tuition to residents of neighboring states’ counties that border their state. These reciprocity agreements recognize the natural flow of students across nearby state boundaries.

Legacy exceptions

A few institutions offer legacy exceptions that grant in state tuition to children of alumni, disregarding of the student’s current state of residence.

Appeal residency decisions

If your residency claim is denied, most institutions and state higher education authorities have formal appeal processes:

Understand the denial

Request specific information about why your residency claim was rejected. Will identify the exact criteria you’ll fail to meet will help you’ll address those specific issues in your appeal.

Gather additional evidence

Strengthen your appeal by provide additional documentation that specifically address the weaknesses in your original application. This might include affidavits from employers, landlords, or community members attest to your permanent presence in the state.

Time your appeal

Appeals typically have strict deadlines. Submit your appeal as other as possible to ensure its review before tuition payment deadlines and financial aid disbursements.

Residency verification on the FAFSA

The FAFSA itself ask comparatively simple questions about your state of legal residence and how yearn you have live thither. Nonetheless, these answers can trigger verification processes:

FAFSA residency questions

The FAFSA ask for your state of legal residence and the date you become a legal resident of that state. Answer these questions base on your actual legal residency status, not where you hope to establish residency.

Verification process

If there be discrepancies between your FAFSA residency information and other records, or if your residency date is recent, you may be select for verification. During this process, your school’s financial aid office may request additional documentation to confirm your residency status.

Maintain residency while study

Once you’ve established residency, you must maintain it throughout your education tcontinue to receiveve in state benefits:

Source: go.tjc.edu

Continuous physical presence

While temporary absences for vacations are permit, extend periods off from the state (such as study abroad programs or internships in other states )should be approach cautiously. Some states have provisions that allow students to maintain residency during education relate absences, but you should verify these policies before make plans.

Annual verification

Many institutions require annual verification of continued residency status. Keep your documentation current and be prepared to demonstrate your ongoing commitment to the state each academic year.

Conclusion: plan beforehand for residency status

Establish state residency for FAFSA and tuition purposes require careful planning and documentation. The financial benefits — both in reduce tuition and access to state aid programs — can be substantial, but the process takes time and commitment.

Begin research the specific requirements of your target state advantageously in advance, ideally 12 24 months before you plan to apply for in state status. Document every step you take to establish residency, and maintain consistent behavior that demonstrate your intent to remain in the state permanently.

By understand the residency requirements and plan strategically, you can potentially save thousands of dollars on your college education while maximize your eligibility for financial aid through the FAFSA process.