College Pricing Explained: The Gap Between Sticker Prices and Net Costs

Understanding college costs: sticker prices vs. Net costs

When explore higher education options, many prospective students and their families experience sticker shock at the publishing tuition rates. Nonetheless, these advertise prices seldom tell the complete story of college affordability. The difference between sticker prices and net costs represent one of the nearly misunderstood aspects of higher education financing.

Net costs are systematically lower than sticker prices for most students at most institutions. This pricing gap create both opportunities and confusion in the college selection process.

What are sticker prices?

Sticker prices represent the publishing, advertise cost of attendance at a college or university before any financial aid appliedply. These figures typically include:

- Tuition and fees

- Room and board

- Books and supplies

- Personal expenses

- Transportation costs

At prestigious private universities, these sticker prices can exceed $80,000 per year. Public universities broadly advertise lower sticker prices, particularly for in state students, but these costs have likewise rrisenconsiderably over time.

What are net costs?

Net costs reflect what students and families really pay after subtract grants, scholarships, and other forms of financial aid that don’t require repayment. The formula is straightforward:

Net cost = sticker price grants and scholarships

This calculation exclude loans, which must be repaid with interest, and work study opportunities, which require student labor in exchange for funds.

The price gap: why net costs are lower

Institutional financial aid

Colleges and universities offer substantial institutional aid to attract qualified students. Many private institutions with high sticker prices maintain large endowments that allow them to offer generous financial aid packages.

Harvard University, for example, have a sticker price approach $80,000 yearly, yet families earn less than $$75000 typically pay nothing, and those earn upwards to $ $15000 much pay no more than 10 % of their income.

Need base federal aid

The federal government provide significant need base aid through programs like:

- Well grants (up to $$7395 per academic year ))

- Federal supplemental educational opportunity grants (ffrog))

- Teach grants for future teachers

These programs specifically target students from lower income backgrounds, create substantial reductions in net costs for qualifying students.

Merit base scholarships

Many institutions offer merit scholarships base on academic achievement, special talents, leadership potential, or other distinguish characteristics. These awards much apply disregarding of financial need and can importantly reduce costs for eminent achieve students.

State flagship universities often use merit aid to attract top students who might differently attend private institutions. Some offer full tuition scholarships to students with exceptional academic credentials.

State programs

Individual states oftentimes provide grants and scholarships to residents attend in state institutions. Programs like Georgia’s hope scholarship, Florida’s bright futures, and New York’s excelsior scholarship can dramatically reduce costs for qualifying students.

The data: how big is the gap?

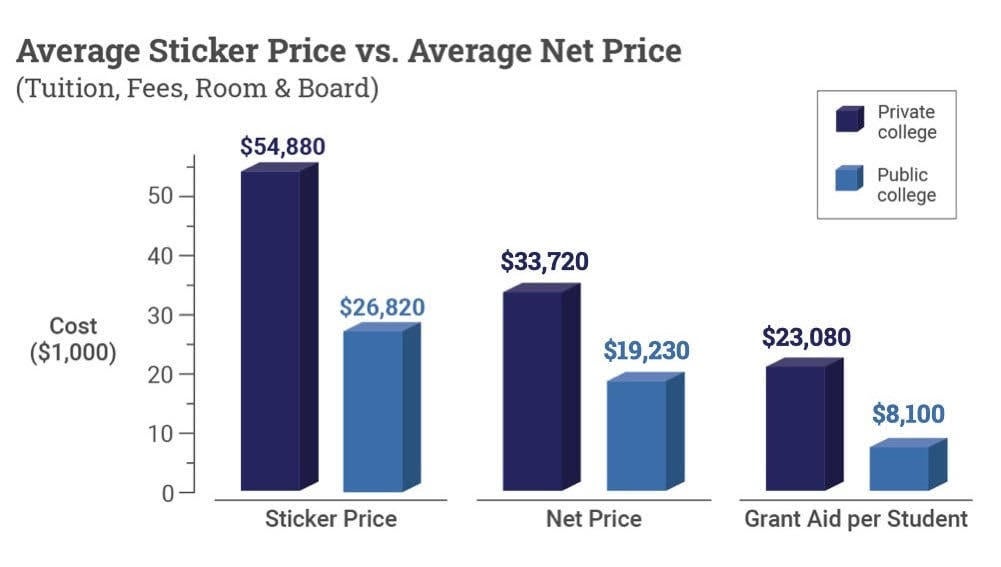

Private nonprofit four year institutions

The difference between sticker and net prices is near dramatic at private colleges and universities:

- Average publish tuition and fees: roughly $39,400

- Average net price pay: roughly $14,500

- Difference: approximately $24,900 ((3 % reduction ))

At the almost selective private institutions, the gap can be yet larger. Most 70 % of students at private nonprofit colleges receive institutional grants average over $21,000.

Public four year institutions

The gap exist at public universities’ angstrom considerably, though it’s typically smaller:

- Average in state publish tuition and fees: roughly $10,940

- Average net price pay: roughly $3,740

- Difference: approximately $7,200 ((6 % reduction ))

Public institutions broadly have smaller endowments than elite private colleges, limit their ability to offer institutional aid. Nonetheless, lower sticker prices combine with state and federal aid however create significant reductions for many students.

Why colleges maintain high sticker prices

Price discrimination strategy

Colleges employ a pricing strategy know as price discrimination, charge different amounts to different students base on their ability to pay and their desirability to the institution. High sticker prices allow schools to:

- Collect maximum revenue from wealthy families who can afford full price

- Offer target discounts to attract specific student populations

- Maintain flexibility in financial aid budgeting

Prestige signaling

Many consumers associate higher prices with higher quality. Colleges leverage this psychological tendency by set high sticker prices that signal exclusivity and prestige. A low advertise price might unknowingly suggest lower educational quality to prospective students and families.

Anchor effect

The anchoring effect is a cognitive bias where people rely heavy on the first piece of information encounter when make decisions. When colleges set high sticker prices, financial aid offer that reduce costs by tens of thousands of dollars can seem like exceptional bargains, yet if the final price remains substantial.

Who benefit near to gap?

Middle income families

Counterintuitively, middle income families oftentimes benefit nearly from the gap between sticker and net prices. While the wealthiest families pay confining to full price and the poorest families qualify for maximum aid from both institutional and government sources, middle income families receive target institutional aid design to make attendance feasible.

Many colleges explicitly focus discount strategies on families earn between $75,000 and $$150000 yearly, who might differently find costs prohibitive but don’t qualify for substantial need base aid.

High achieve students

Students with exceptional academic credentials, disregarding of financial need, much receive substantial merit scholarships that create large gaps between sticker and net prices. Institutions use these scholarships to improve their academic profiles and rankings by attract students with high test scores and gas.

Students with specialized talents

Colleges seek to build diverse student bodies with talents in areas include:

- Athletics

- Perform arts

- Visual arts

- Leadership

- Community service

Students who excel in these areas much receive significant aid packages that reduce net costs considerably below sticker prices.

Source: nytimes.com

The downsides of the pricing gap

The deterrent effect

High sticker prices discourage many qualified students from yet apply to certain institutions. Studies show that low income and first generation students oftentimes practice” self sort, ” void applications to schools with high publish prices despite potentially qualify for substantial aid that would make these institutions affordable.

Source: stedwards.edu

This effect contribute to persistent socioeconomic stratification in higher education, with talented lower income students underrepresented at elite institutions.

Complexity and uncertainty

The financial aid system’s complexity create significant uncertainty for families try to plan for college expenses. Students typically can’t know their actual net cost until after apply and receive financial aid offers, make early college planning difficult.

This uncertainty affect college choices, with many students select less expensive options base on sticker prices kinda than wait to compare actual net costs.

Annual variability

Net prices can change from year to year base on:

- Changes in family financial circumstances

- Institutional aid policies

- Academic performance requirements for merit scholarships

- Federal and state funding levels

This variability introduces additional uncertainty into the college financing process, as initial aid packages may not remain consistent throughout a student’s academic career.

How to navigate the gap between sticker and net prices

Use net price calculators

Federal law require colleges to provide net price calculators on their websites. These tools estimate the actual cost of attendance base on family financial information and student characteristics. While not utterly accurate, they provide practically better cost estimates than sticker prices unparalleled.

Apply generally

Students should consider apply to institutions across a range of price points. High sticker price schools sometimes offer more generous aid packages than schools with lower publish rates, result in counterintuitive net price comparisons.

Negotiate financial aid offer

Many institutions are willing to adjust financial aid packages, particularly when present with compete offers from similar schools. This negotiation process can air reduce net costs below initial offers.

Consider the complete return on investment

When evaluate college costs, students should consider not fair the immediate price but the long term return on investment, include:

- Graduation rates

- Average time to degree completion

- Career placement rates

- Average starting salaries for graduates

- Loan repayment rates

A higher net price at an institution with better outcomes might represent a better value than a lower price at an institution with poorer outcomes.

The future of college pricing

Transparency initiatives

Grow criticism of the current pricing model has lead to calls for greater transparency. Some institutions have adopt” ” guarantee net pric” models that provide clearer, more consistent information about actual costs throughout a student’s academic career.

Reset strategies

A small but grow number of colleges have implement” ” tuition rese” strategies, considerably lower sticker prices while to reduce institutional aid. These approaches aim to reduce sticker shock while maintain similar net revenue.

Policy proposals

Various policy proposals aim to address the pricing gap, include:

- Free community college initiatives

- State college promise programs

- Federal state partnerships to reduce public university costs

- Expand income base repayment options for student loans

These proposals could importantly alter the relationship between sticker and net prices in coming years.

Conclusion

The substantial gap between sticker prices and net costs represent both a challenge and an opportunity in higher education financing. While high publish prices create barriers to access and contribute to public perceptions of affordability, the actual net prices pay by most students are substantially lower.

Understand this gap and learn to navigate the financial aid system efficaciously can dramatically expand educational opportunities for students across the socioeconomic spectrum. As transparency initiatives and policy reforms will continue to will evolve, the relationship between sticker and net prices will probably will change, potentially will create a more accessible and understandable system for future students.

For straightaway, the virtually important takeaway for prospective students and families is clear: ne’er rule out an educational option base exclusively on its sticker price without investigate the potential net cost after financial aid.